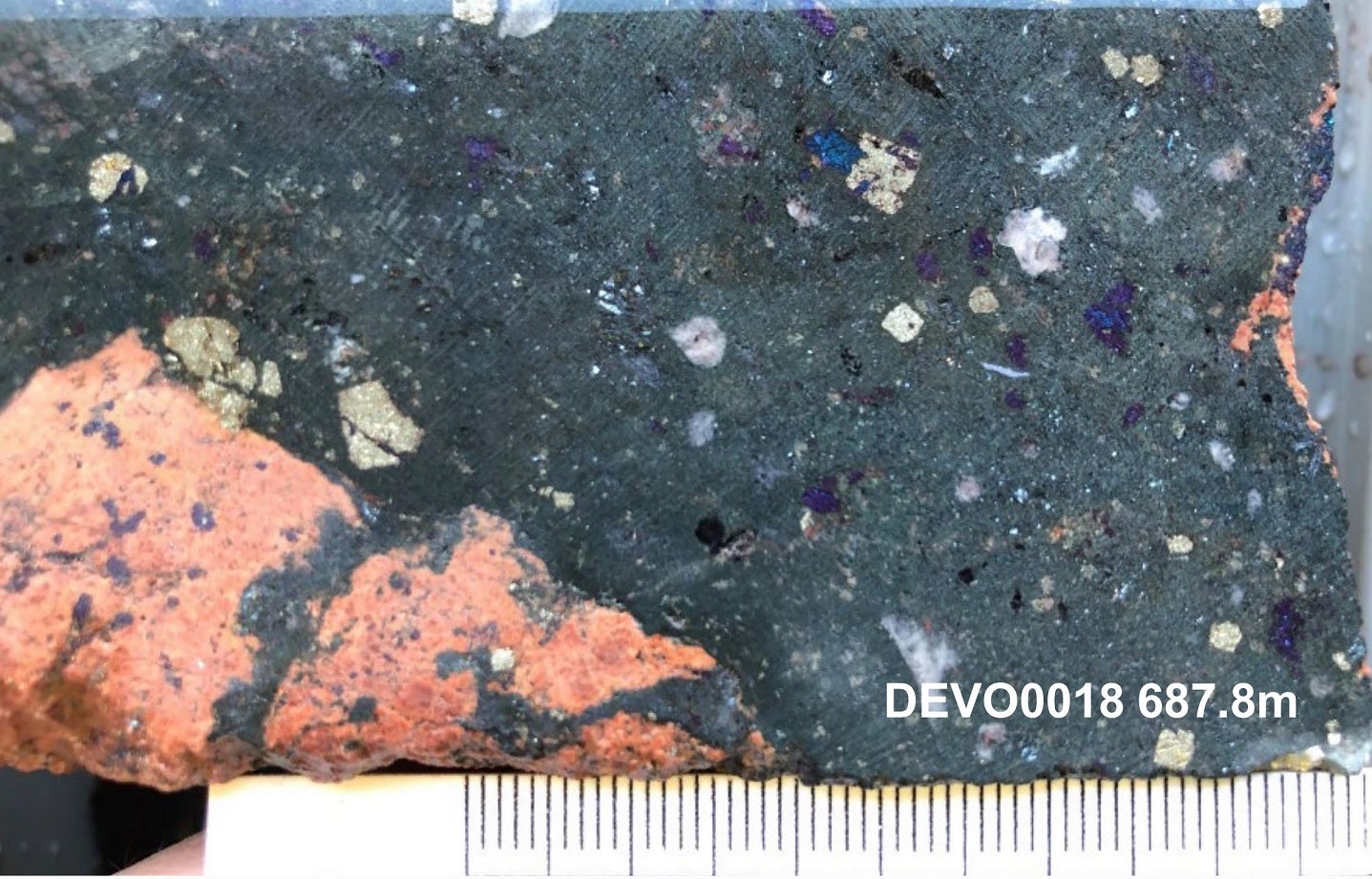

Wimberu Prospect Hydrothermal breccia. Credit: Carnaby Resources.

Australian company Carnaby Resources has signed a farm-in and joint venture (JV) agreement with Rio Tinto subsidiary Rio Tinto Exploration (RTX) to earn a 51% interest in the latter’s Devoncourt Project in Australia.

Carnaby expects the acquisition to add a high-quality advanced exploration target while expanding the land position of its Greater Duchess Copper-Gold Project in Mt Isa, Queensland.

Under the agreement, Carnaby will solely fund A$5m ($3.28m) for exploration at the property by 1 August 2028.

The company is required to make an upfront payment of A$100,000 to RTX, either in cash or fully paid ordinary shares.

As part of the expenditure commitment, Carnaby will also complete a minimum of 4,000m of diamond core and/or reverse circulation drilling. It will also undertake a A$500,000 minimum expenditure commitment.

Upon achieving the farm-in requirements by Carnaby, RTX may either or not elect to contribute to JV expenditure.

Carnaby managing director Rob Watkins said: “The Devoncourt farm-in with RTX gives Carnaby a unique opportunity for a junior to explore a Tier 1-sized target within a world-class mineral field and jurisdiction.

“We believe that in conjunction with the highly successful ongoing exploration and potential development of the Greater Duchess Project, Devoncourt represents a highly accretive addition to the existing exploration targets within the Greater Duchess area.”

Encompassing 838km² of exploration tenure, the Devoncourt Project includes the Wimberu granite, which is said to be a potential source of iron ore copper-gold mineralised fluids.

The project comprises several magnetic and gravity highs including the Wimberu Prospect.

This article was published by: Archana Rani

Visit the original article here